IndoFinanceGuide is an online financial education and content platform that focuses on simplifying money, investing, and personal finance topics for readers, especially in Indonesia. It aims to help beginners and experienced individuals improve their financial knowledge and make smarter decisions.

Overview

IndoFinanceGuide provides practical financial guidance, including saving, investing, budgeting, and financial news. The platform is designed to make finance easy to understand through simple explanations and useful tips.

According to its official information, IndoFinanceGuide is a trusted space for learning about money, investing, and financial trends with clear and practical advice.

IndoFinanceGuide-style financial planning is typically divided into four primary components:

| Financial Component | Functional Purpose | Expected Outcome |

| Investasi Pintar | Smart Investment Planning | Capital Growth |

| Uang Cerdas | Budgeting & Expense Management | Savings Optimization |

| Berita Finansial | Market Awareness | Risk Reduction |

| Pendidikan Keuangan | Financial Education | Strategic Decision Making |

Together, these components form a comprehensive financial management ecosystem designed to improve financial literacy and maximize long-term investment performance.

Key Content Categories of IndoFinanceGuide

IndoFinanceGuide focuses on providing financial education through different content areas that help readers understand and manage money effectively.

1️. Smart Investing (Investasi Pintar)

This category covers investment-related topics for beginners and experienced investors.

Main topics include:

- Stock market basics

- Mutual funds and bonds

- Long-term wealth creation

- Risk management

- Portfolio diversification

- Beginner-friendly investment guides

The goal is to help readers start investing confidently and grow their wealth over time.

2️. Smart Money (Uang Cerdas)

This section focuses on daily financial management and improving money habits.

Main topics include:

- Budgeting and expense tracking

- Saving strategies

- Managing debt and loans

- Emergency funds

- Financial discipline

It helps individuals manage their income better and avoid financial stress.

3️. Financial News (Berita Finansial)

Provides updates and insights on current financial and economic trends.

Main topics include:

- Market trends and analysis

- Economic developments

- Global and local finance news

- Currency and inflation updates

- Investment opportunities

This category keeps readers informed about changes in the financial world.

4️. Financial Education (Pendidikan Keuangan)

Focuses on improving financial literacy and understanding basic concepts.

Main topics include:

- Personal finance fundamentals

- Financial planning

- Understanding financial products

- Retirement planning

- Wealth management basics

The aim is to build strong financial knowledge for long-term success.

5️. Lifestyle & Money

Some content also connects finance with daily life and modern lifestyle.

Main topics include:

- Financial planning for life goals

- Managing money for travel, family, or business

- Smart spending habits

- Digital payments and fintech

This helps readers connect financial decisions with real-life situations.

Key Features of IndoFinanceGuide

| Feature | Description |

| Beginner-Friendly Content | Provides simple and easy-to-understand financial information suitable for beginners and students. |

| Financial Literacy Focus | Promotes awareness about saving, budgeting, investing, and money management. |

| Practical Advice | Offers real-life tips and strategies that readers can apply in daily financial decisions. |

| Wide Range of Topics | Covers investing, personal finance, financial planning, and economic updates. |

| Updated Financial News | Shares current trends, market insights, and economic developments. |

| Smart Investment Guidance | Helps users understand stocks, mutual funds, and long-term wealth creation. |

| User-Centered Approach | Content is designed to address common financial challenges and goals. |

| Educational Resources | Includes guides, tutorials, and learning materials for financial growth. |

| Digital & Online Platform | Easily accessible through online content and digital media. |

| Focus on Young Professionals | Targets students, beginners, and young earners interested in financial growth. |

| Financial Independence Awareness | Encourages long-term planning and wealth-building mindset. |

| Simple Language & Clear Structure | Uses straightforward language to explain complex financial concepts. |

Investasi Pintar: Understanding Smart Investment Strategy

Investment planning plays a crucial role in transitioning from active income dependency to passive wealth accumulation. The primary objective of investing is to generate returns that exceed inflation while managing exposure to financial risk. (indofinanceguide.com)

Common Investment Options for Beginners

| Investment Instrument | Risk Level | Average Annual Return | Liquidity |

| Fixed Deposits | Low | 5% – 7% | High |

| Government Bonds | Low | 6% – 8% | Low |

| Mutual Funds | Medium | 10% – 14% | Medium |

| Gold ETFs | Medium | 8% – 10% | High |

| Stocks | High | 12% – 18% | High |

Each of these instruments serves a different purpose within a diversified portfolio.

- Fixed Deposits provide capital protection.

- Government Bonds offer stable income streams.

- Mutual Funds balance risk and return.

- Gold ETFs hedge against inflation.

- Stocks deliver high long-term growth potential.

It is the diversification of these asset classes that would reduce the risk of unsystematic risk and help ensure the stability of a portfolio in case of a decline in the market.

Direct vs Regular Mutual Fund Plans

One of the most available investment tools to new investors is the mutually funds. The choice of direct and regular plans however, has a great influence on the returns in the long term.

| Parameter | Direct Plan | Regular Plan |

| Expense Ratio | Lower | Higher |

| Returns | Higher (Long Term) | Moderate |

| Commission | Not Included | Included |

| Investor Control | High | Medium |

| Advisory Support | Self-Managed | Advisor-Managed |

Direct mutual fund plans eliminate distributor commissions, allowing investors to benefit from compounding over extended investment horizons.

Mission and Vision of IndoFinanceGuide

Mission

The mission of IndoFinanceGuide is to:

- Promote financial literacy among individuals and young professionals

- Simplify complex financial and investment concepts

- Help people make informed decisions about saving, investing, and budgeting

- Encourage smart money management habits

- Provide accessible financial education for all income levels

The platform focuses on practical, easy-to-understand financial guidance that empowers readers to build long-term financial stability.

Vision

The vision of IndoFinanceGuide is to:

- Become a trusted and leading financial education platform in Indonesia

- Increase awareness about responsible investing and wealth creation

- Support a financially educated and independent society

- Contribute to economic growth through improved financial knowledge

In simple terms, IndoFinanceGuide aims to create a community where people confidently manage their money and make smarter financial choices.

Uang Cerdas: Budgeting and Expense Optimization

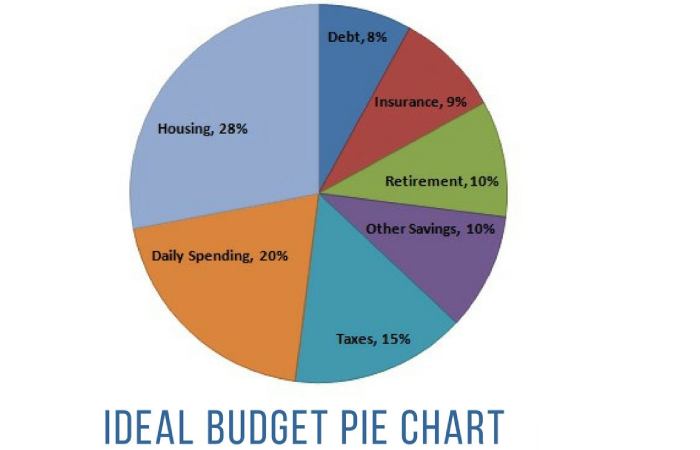

Budgeting is one of the most fundamental aspects of financial planning. Without structured expense management, investment participation becomes inconsistent and savings rates decline.

One of the most widely adopted budgeting frameworks is the 50-30-20 rule.

50-30-20 Budgeting Model

| Expense Category | Percentage Allocation | Monthly Allocation (₹70,000 Income) |

| Needs | 50% | ₹35,000 |

| Wants | 30% | ₹21,000 |

| Savings & Investment | 20% | ₹14,000 |

This budget will see to it that the key costs are covered and at the same time will provide a steady level of investment input.

Expense Reduction Strategies

To maximize cash flow on monthly basis, people might adopt the following practices;

- Track daily discretionary expenses.

- Automate savings contributions.

- Eliminate redundant subscription services.

- Avoid high-interest consumer loans.

- Reduce impulse-based purchases.

- Maintain emergency reserves.

Consistent expense monitoring improves liquidity management and enhances investment participation rates.

Financial Literacy for Beginners

Financial literacy programs typically emphasize foundational concepts such as:

- Income Statement Interpretation

- Balance Sheet Analysis

- Credit Score Evaluation

- Loan Structures

- Risk Management Techniques

Understanding these financial metrics enhances decision-making across investments and expense planning.

Importance of Platforms Like IndoFinanceGuide

Financial education platforms play a vital role in improving awareness, decision-making, and long-term financial stability. Below is a table showing their importance:

| Importance Area | Explanation |

| Financial Literacy | These platforms help people understand basic financial concepts such as saving, investing, and budgeting, which many individuals do not learn in school. |

| Smart Decision-Making | They guide users in making informed financial choices about loans, investments, and spending, reducing financial mistakes. |

| Wealth Creation | By teaching long-term investing and financial planning, they support individuals in building wealth over time. |

| Debt Management | Users learn how to control debt, avoid unnecessary loans, and manage credit responsibly. |

| Awareness of Financial Products | Platforms explain banking, insurance, mutual funds, and other financial tools, helping users choose the right products. |

| Support for Beginners | Beginner-friendly content reduces fear and confusion about finance and investing. |

| Economic Growth | A financially educated population contributes to national economic development and stability. |

| Digital Financial Inclusion | Online platforms reach rural and underserved populations, promoting access to financial knowledge. |

| Investment Culture | They encourage a habit of investing rather than only saving, which supports capital markets. |

| Risk Awareness | Users learn about financial risks, scams, and fraud prevention, improving financial safety. |

| Career and Skill Development | Knowledge in finance can open career opportunities in banking, investing, and fintech. |

| Global Financial Awareness | These platforms provide information on global markets, trends, and economic changes. |

Target Audience of IndoFinanceGuide

IndoFinanceGuide is designed to serve a wide range of individuals who want to improve their financial knowledge and make smarter money decisions.

1️. Young Professionals

This group includes people in the early stages of their careers who want to:

- Learn budgeting and saving

- Start investing

- Manage salaries and expenses

- Plan for future financial goals

The platform helps them build strong financial habits from the beginning.

2️. Students and Beginners

IndoFinanceGuide is beginner-friendly, making it ideal for:

- College and university students

- First-time investors

- Individuals new to personal finance

It provides simple and clear guidance to help them understand basic financial concepts.

3️. New Investors

The platform targets people who want to:

- Start investing in stocks, mutual funds, or other assets

- Understand risks and returns

- Build long-term wealth

- Learn portfolio management

It reduces fear and confusion about investing.

4️. Middle-Income Individuals

People who want to improve their financial stability and lifestyle can benefit from:

- Financial planning

- Saving for big goals like homes or education

- Managing loans and debt

The content supports practical financial growth.

5️. Entrepreneurs and Small Business Owners

IndoFinanceGuide also appeals to:

- Startup founders

- Freelancers

- Small business owners

They can learn about:

- Business finance basics

- Cash flow management

- Investment strategies

- Financial decision-making

6️. Financial Literacy Enthusiasts

This includes individuals interested in:

- Learning about money and economics

- Understanding market trends

- Staying updated with financial news

- Improving financial awareness

7️. Digital and Tech-Savvy Users

Since the platform is online, it attracts:

- Mobile and internet users

- People interested in fintech and digital payments

- Those looking for modern financial solutions

FAQ Section

Q1. What is IndoFinanceGuide financial planning?

It is an organized system of handling income, savings and investments to create long term wealth.

Q2. How much money should be saved every month?

Savings or investments instruments should constitute at least 20 percent of monthly income.

Q3. What is the significance of diversification?

Diversification lowers the volatility of investment and enhances resilience of the portfolio.

Q4. How much is the perfect size of the emergency funds?

Three-six months living expenses.

Conclusion

IndoFinanceGuide financial planning structure combines budgeting discipline, diversification investment strategies, tax efficient instruments and literacy driven decision models into a unified system of personal finance. Through systematic allocation algorithms and contingency reserves, people can devise scalable financial development policies that are in line with the long terms capital growth targets.